How Belgium plans for recovery in the post-Covid world.

Apr 28, 2020

07:00 min read

Tontines to rebuild the economy after a pensions crisis

Dean McClelland

Moneytalk: "The coronavirus has done a lot of damage to our economy. By activating savings and investing in Belgian companies via tontines, we can give oxygen to the economy and citizens can increase their supplementary pension". That's what finance professors Kris Boudt (UGent) and Steven Vanduffel (VUB) say. Hey, the experts are saying it too, not just us,

(If you want to read the translation of the original MoneyTalk.be article, click here.)

Tontines: a solution to the pension crisis and the rebuilding of the economy?

The media's focus on the coronavirus crisis temporarily pushes other important problems, which until recently had a lot of attention, into the background. Suddenly, the pension crisis is on the back burner. Coronavirus or not, the average lifespan of the Belgian population is still crescendo. As a result of medical progress, many people will complete the 100-year cape.

The fact that problems such as the pension crisis currently receive hardly any attention is not only striking but also understandable. The corona crisis and its economic consequences are a reality that we will also have to take into account when tackling other challenges facing our society.

Cash and cash equivalents for companies

In spite of the many temporary public support measures for companies and individuals, many companies that were in dire financial health only a few months ago are incurring losses. In the long and medium term, many companies will need a capital injection in the form of cash. Spending even more public money may no longer be an option, given the public debt and large deficit. And relying solely on traditional, wealthy investors to drive our economy may be a naïve idea.

We therefore want to argue here for the creation of tontines, which can provide an elegant solution to both problems.

Tontines

A tontine is a long-term financial contract between companies and citizens who want to invest money. They are represented, for example, by the government, consumers and professional associations or trade unions. For each tontine, a management committee is appointed that decides in which companies money will be invested. This can take into account the preferences of the participating citizens, who can choose between three strategies: defensive, neutral and aggressive.

The tontine agreement stipulates that the proceeds of the investments in the tontine will only be used to pay out supplementary pensions to the members, on top of the statutory pension. As with the statutory pension, each member will only be able to obtain this income if he or she is still alive at the agreed retirement age and only for as long as he or she lives. People who live long therefore receive more than unlucky people who die earlier, but that is also the case with the statutory pension. Participants put money together in a fund, the fund invests in a sensible way in the economy and the proceeds are distributed to the participants in the form of monthly benefits.

The tontine complements your statutory pension (and any group insurance you may have) because it provides payouts until you die, even if you turn 120. The participants agree in advance how they will distribute the revenues among themselves. One can opt for a fixed expected amount, but also anticipate increasing expenses by opting for payouts that increase with age.

Cheaper alternative

There are de facto only two alternatives to cover the 'risk of longevity' in Belgium. The first alternative is the statutory pension, which is unfortunately insufficient for many people to enjoy a carefree old age. The second alternative is to take out insurance, under which you receive a monthly sum from retirement age until death, known as an annuity. Annuities are difficult to obtain on the Belgian market and often expensive. Tontines can offer a cheaper alternative.

By activating savings and investing via tontines in Belgian companies that are short of liquid assets, we give oxygen to our economy and citizens can increase their supplementary pension.

The difference in price is due to the fact that with a tontine the monthly amounts are not guaranteed by the insurer. The participants insure each other's longevity risk. In this way you avoid the high costs that an insurer charges as a result of mandatory capital buffers and heavy administration, as well as too low an annuity by systematically overestimating life expectancy. In the case of tontines, everything is calculated in such a way that the income is distributed fairly among the participants - among other things by using the real life expectancy of the participants - and the only additional costs are those of management.

This cost efficiency is offset by the slightly higher risk of a tontine. By investing in Belgian companies, participants bear some investment risk, just as with an ordinary investment fund. It can therefore happen that the initially expected pension amounts have to be adjusted downwards because the expected return does not materialise. But the reverse is also possible. It is also possible that on average the participants live much longer than expected, which means that adjustments will eventually have to be made. However, the reverse scenario also exists, in which participants live shorter than expected and the pension amounts can be increased.

Oxygen for the economy

We consider this moment ideal for the start-up of tontines in Belgium. The coronavirus has done a lot of damage to our economy. By activating savings and investing via tontines in Belgian companies that are short of liquid assets, we give oxygen to our economy and citizens can increase their supplementary pension.

The tontine is in line with various calls in the media for the creation of a large investment fund to boost the equity capital of companies. We welcome this proposal, but stress the importance of launching the fund as a retirement savings product. Provided they are well designed, tontines can create a win-win situation for pension savers and ailing Belgian companies. No time to lose.

In April 2020, award-winning finance professors Kris Boudt (UGent) and Steven Vanduffel (VUB) wrote in MoneyTalk.be: "The coronavirus has done a lot of damage to our economy. By activating savings and investing in Belgian companies via tontines, we can give oxygen to the economy and citizens can increase their supplementary pension".

A month later the Belgian government agreed on "a huge grant" to make it happen.

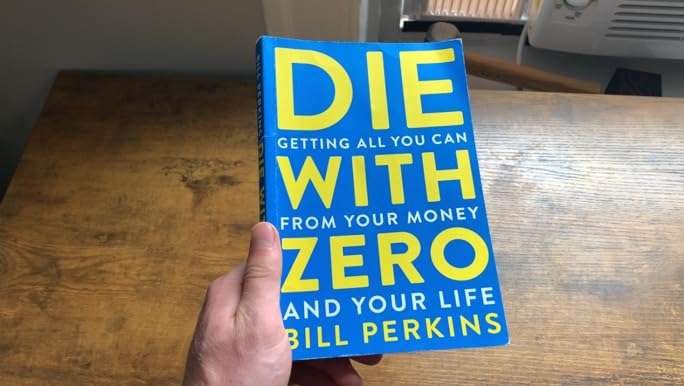

Book Review: Die with Zero by Bill Perkins

The aim of the book is to help you shift focus from maximizing wealth to maximizing life experiences.

What Is a Tontine? Should You Invest In One?

Ruth Saldanha asks: Is a Tontine the Best Way to Get Income in Retirement?

Opinion: DoL must regulate IRA accounts

Kerry Pechter, author of Annuities for Dummies & editor of the RIJ explains why new rules on annuities are needed